April Market Report: Local Home Prices Dip in April - Could this turn into a trend?

The median sales price for home sales in April was down year-over-year and month-over-month in both Ada and Canyon counties.

In Ada County, the median sales price for homes that closed last month was $545,821, approximately $9,000 less than in April 2024 and down about $19,000 month-over-month. Canyon County had a median sales price of $415,000 in April, $15,000 less than the same month a year ago and nearly $10,000 less than last month.

Could this shift in prices be the beginning of a trend of declining home prices for the Treasure Valley? While one month showing a drop isn’t considered a trend, there are a few factors that are worth exploring.

Prices are driven by supply versus demand, and we’ve experienced 15 consecutive months of year-over-year inventory gains in both Ada and Canyon County. As inventory accumulates, we get closer to a balanced market (not favoring buyers or sellers) which could lead to downward pressure on home prices. In April, inventory, or listed homes for sale, increased by 35.6% in Ada County and 19.1% in Canyon County, year-over-year.

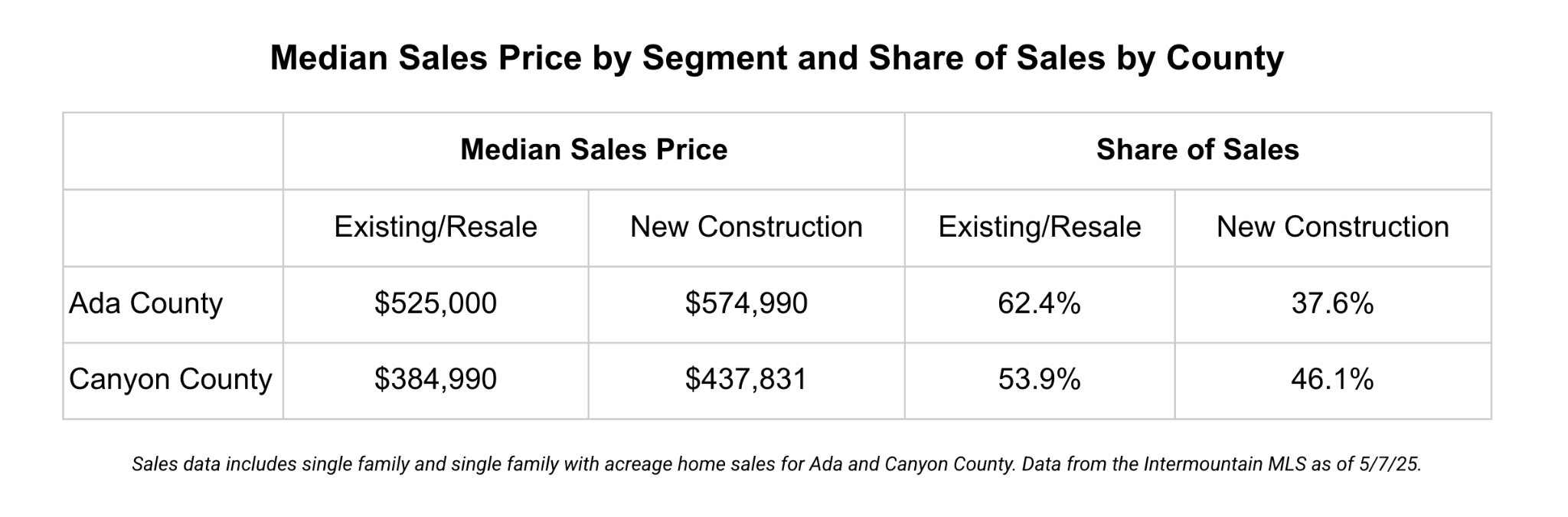

Additionally, the mix of what sells in a given month will impact the median sales price for that month. Existing/resale homes typically sell for less than new construction, so as more resale homes came online and accumulated during the spring selling season, it gave buyers more options at lower price points. Over 60% of all Ada County home sales and over half of all Canyon County home sales were existing/resale homes. This uptick in existing/resale sales at lower price points pulled the overall median home sales price down.

Increased inventory is good news for today’s buyers – it means more options at more price points and they aren’t facing the same competition we saw in the market a few years ago. But what about the demand factor of the equation? Will the supply of homes outpace demand, leading to further price declines?

There are a number of factors that impact housing demand, but the most notable in today’s market is mortgage interest rates. For the later part of April and into the first week of May, the 30-year fixed rate mortgage average has been in the 6.81-6.76% range, holding buyer demand back and softening price growth.

However, pending sales, or homes that have gone under contract and haven’t closed yet, show that demand hasn’t dried up in the Treasure Valley. Monthly pending sales in 2025 have outpaced 2024 and 2023 for every month so far and are currently trending up.

We expect that if the 30-year fixed rate mortgage average drops toward the 6% range and stays there, it will further boost buyer activity and home sales.

Understanding these local market trends can help buyers and sellers set realistic expectations. But ultimately, deciding when to make a move depends on your individual goals. A trusted real estate professional will negotiate on your behalf, address the potential hurdles to a transaction, and utilize their industry knowledge and connections to get the job done. The Agency Boise is made up of a select group of driven agents that have deep roots in the community, local expertise, and are backed with a regional and global reach. Who you work with, matters.